All Categories

Featured

Table of Contents

That usually makes them a more budget-friendly choice forever insurance policy coverage. Some term plans may not keep the costs and death benefit the very same in time. You do not want to incorrectly assume you're purchasing degree term coverage and after that have your survivor benefit modification later. Lots of people get life insurance policy protection to aid economically safeguard their enjoyed ones in situation of their unanticipated death.

Or you might have the choice to transform your existing term insurance coverage into a long-term plan that lasts the rest of your life. Various life insurance plans have prospective advantages and drawbacks, so it's important to recognize each prior to you choose to acquire a policy.

As long as you pay the premium, your recipients will certainly get the survivor benefit if you die while covered. That claimed, it's essential to keep in mind that the majority of policies are contestable for 2 years which means coverage can be retracted on death, ought to a misstatement be discovered in the app. Policies that are not contestable usually have actually a rated survivor benefit.

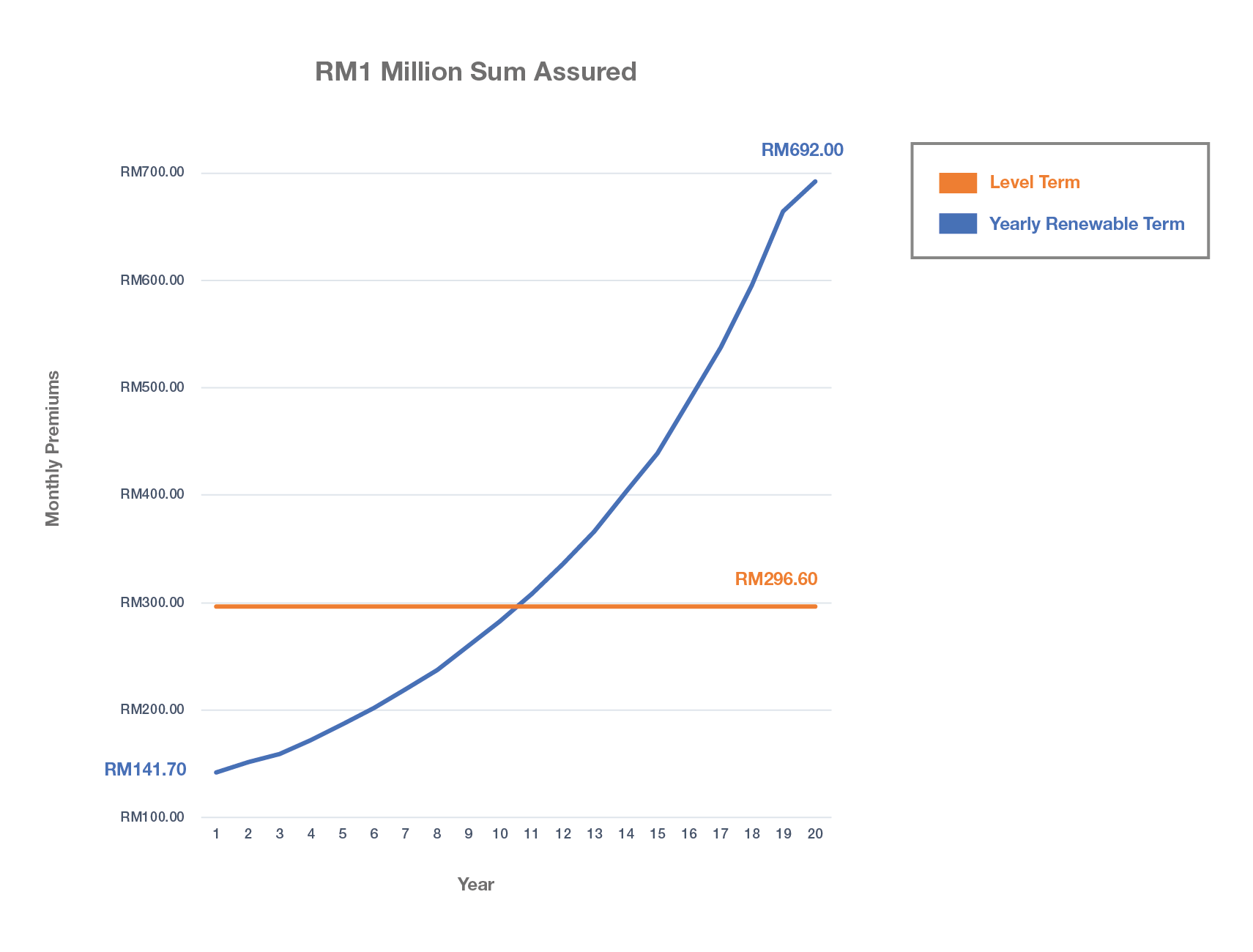

Costs are typically lower than entire life policies. With a degree term plan, you can pick your coverage amount and the policy length. You're not secured into an agreement for the remainder of your life. Throughout your policy, you never ever need to bother with the costs or survivor benefit quantities transforming.

And you can not pay out your plan throughout its term, so you will not receive any type of economic benefit from your past coverage. Just like various other sorts of life insurance policy, the cost of a degree term policy relies on your age, protection needs, work, way of life and health. Generally, you'll locate much more budget friendly coverage if you're younger, healthier and less high-risk to insure.

Value Term Life Insurance With Accelerated Death Benefit

Given that degree term costs stay the exact same for the period of coverage, you'll recognize specifically how much you'll pay each time. Degree term protection likewise has some versatility, allowing you to personalize your plan with additional features.

You might need to satisfy particular conditions and credentials for your insurer to establish this cyclist. Additionally, there may be a waiting duration of approximately 6 months prior to taking effect. There also can be an age or time frame on the insurance coverage. You can include a youngster rider to your life insurance plan so it additionally covers your youngsters.

The fatality advantage is commonly smaller, and protection generally lasts up until your child transforms 18 or 25. This cyclist may be a much more affordable method to aid ensure your children are covered as bikers can often cover numerous dependents at the same time. When your child ages out of this coverage, it might be feasible to transform the cyclist right into a brand-new plan.

The most typical type of irreversible life insurance policy is entire life insurance policy, however it has some crucial distinctions contrasted to level term insurance coverage. Here's a basic summary of what to think about when contrasting term vs.

Top The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

Whole life entire lasts for life, while term coverage lasts insurance coverage a specific periodCertain The costs for term life insurance coverage are usually reduced than entire life coverage.

Among the major features of degree term protection is that your premiums and your fatality benefit don't transform. With decreasing term life insurance coverage, your costs stay the same; nonetheless, the survivor benefit quantity obtains smaller in time. For instance, you might have insurance coverage that begins with a fatality advantage of $10,000, which could cover a home mortgage, and afterwards annually, the survivor benefit will reduce by a collection amount or percent.

Due to this, it's typically an extra affordable kind of degree term coverage., but it may not be enough life insurance policy for your needs.

After choosing a policy, finish the application. For the underwriting procedure, you may need to provide basic individual, health, way of living and employment details. Your insurance company will certainly determine if you are insurable and the threat you may provide to them, which is shown in your premium prices. If you're accepted, sign the documentation and pay your initial costs.

Cost-Effective A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

You might desire to upgrade your recipient information if you have actually had any type of considerable life adjustments, such as a marital relationship, birth or divorce. Life insurance coverage can often really feel complex.

No, level term life insurance policy does not have cash worth. Some life insurance policy plans have an investment function that permits you to build cash money worth with time. A section of your costs payments is alloted and can earn passion gradually, which grows tax-deferred throughout the life of your coverage.

You have some options if you still want some life insurance protection. You can: If you're 65 and your insurance coverage has actually run out, for instance, you might want to purchase a new 10-year degree term life insurance plan.

Level Term Life Insurance

You may be able to convert your term protection right into a whole life policy that will last for the remainder of your life. Numerous sorts of level term policies are convertible. That means, at the end of your insurance coverage, you can convert some or every one of your policy to whole life coverage.

Degree term life insurance policy is a plan that lasts a set term generally in between 10 and three decades and comes with a level death advantage and level costs that remain the same for the whole time the policy holds. This indicates you'll recognize specifically how much your repayments are and when you'll need to make them, enabling you to spending plan appropriately.

Degree term can be a great alternative if you're aiming to get life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance policy Measure Research Study, 30% of all adults in the united state need life insurance and don't have any kind of sort of policy yet. Level term life is predictable and economical, that makes it among one of the most prominent kinds of life insurance policy.

Latest Posts

Funeral Insurance For Seniors

Insurance For Funeral Costs

Does Medicare Cover Funeral Costs